Was going through TRAI’s recently released Jan 2018 telecom subscription report. Found some of the numbers interesting and started pulling out historical reports to compare. And before I knew it, I was down a rabbit hole of discovering the very interesting changes in the Indian telecom sector over the last 2 years!

A country of more than a billion mobile users.

Some of the stats might be well-known in isolation but are interesting in context. Like: India, with 1.15 billion wireless subscribers, is the second biggest wireless [mobile] market in the world.

Together, India and China have as many mobile phone users as the next 16 biggest markets!

The launch of Jio in Aug '16 changed the mobile landscape in the country [more on this later]. In the first half of 2016, a total of 1.6Mn new users were added to the category. That number ballooned to 86Mn new mobile users in the second half of 2016. A 53X jump!

Aside: Since the time MNP was made available, a total of 345Mn requests have been placed by mobile users for porting to another operator/circle. That’s almost 30% of users churning out of their current plans/operator, a pretty high % don’t you think?

There’s a very high correlation [0.90] between GDP per Capita of a region and the tele-density of that region.

I am sure there’s not just correlation but causation too, but which way is it?

Is higher tele-density leading to greater efficiency of communication and transactions leading to economy growth of a region? Or are growing economies improving standards-of-living giving rise to higher accessibility of smartphones?

Rural subscriptions grew by only 90,000 in Jan 2018.

Yup, only 0.09Mn growth in wireless access in a rural population of 880Mn :(

More 'mobile data' users in India than total mobile users in the US

There are currently more than 350Mn users of mobile internet services i.e., mobile data users in the country. Technically, this number includes dongles as well but I would assume that number to be relatively small.

This represents 36% of the total Active wireless subscription base! Which is phenomenal considering only 13% of mobile users were using their devices for data only 2 years ago.

Wired broadband connections have pretty much been flat over the last 2 years. Is this a reflection in growth [or the lack of it] of new homes in the country over the last 2 years?

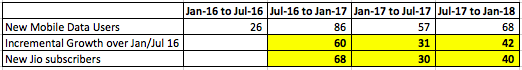

Now this is very interesting. In the period Jan-Jul 2016 [pre-Jio], there were 26Mn new mobile data users. Between Jul-16 and Jan-17, that number went up to 86Mn new mobile data users, with 57Mn and 68Mn new mobile data users coming on-board in the subsequent periods Jan-17-to-Jul-17 and Jul-17-to-Jan-18.

Assuming other operators continued to add mobile data users at the same rate as Jan-Jul 2016, the numbers say something insane!

Mathematically speaking, almost 100% of everyone who have subscribed to Jio have started consuming data.

If he/she is someone moving in from another operator, then this means he/she wasn’t consuming data before but started to as soon as he/she got onto Jio! Jio has clearly ushered in a mobile data revolution more specifically than a mobile usage revolution. More on this below.

The Jio Effect

Can you identify who has lost [in subscription numbers] to Jio in the 18 months since Jio’s launch? The top-3 viz., Airtel, Idea and Vodafone definitely haven't.

Jio has, over the last 12 months, gobbled up the non-Top 3 operators such as Reliance Comm., Tata Docomo and maybe Aircel too? [the shrinking grey area in the plot above].

That’s right. Post the initial surge of market expansion that Jio managed to create [with ~ 86Mn new mobile users being added to the pool between Jul-16 and Jan-17], market growth post that has been relatively modest with only 7.4Mn new subscriptions in the 12 months.

At the same time, buoyed by heightened consumer interest in participating in the mobile revolution [thanks to Jio] and aggressive investments, subscriber growth of the top 3 operators is actually accelerating with both Airtel and Vodafone currently growing the fastest they have in the last 2 years!

Airtel and Vodafone currently growing the fastest they have in the last 2 years.

Of course, it’s also possible that the massive jump of 86Mn new wireless subscriptions in the second-half of 2016 right on the heels of the Jio launch included secondary devices/usage and wasn't all new mobile users. How can we validate this?

What trackable behavior can be predict of a group that already uses a mobile phone but would now like to test Jio’s service too? Well of course, Google searches for dual-SIM phones! Indexed search trends for the term ‘dual sim phone’ on Google almost doubled right around the launch of Jio.

Considering the search numbers are indexed and not absolute, there’s no way to correlate the spike in volume of these searches to Jio subscription numbers. But it’s probable a sizable chunk of the 86Mn new mobile users in the second-half of 2016 were probably old mobile users trying out the Jio service through a brand new dual-SIM phone.

Have we crossed the end point of user-growth?

For the first time in 2 years, active wireless subscriptions in India are de-growing.

Post the headwinds of Jio that we witnessed starting Aug ’16, we are now entering the mature market phase of user-growth. Ok technically, it was mobile subscriptions and not necessarily users.

Urban subscriptions de-grew by 16Mn MoM in Jan 2018. Was probably the Jio effect wearing off and users settling in on one primary subscription after experimenting.

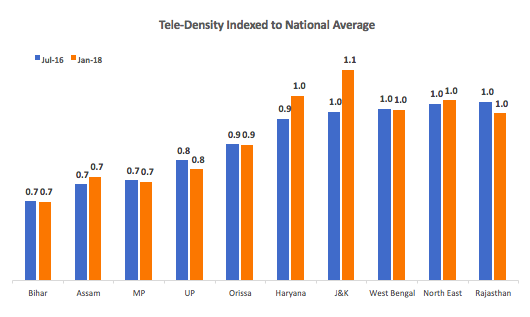

In the 18 months between Jul 2016-Jan 2018 [essentially post-Jio], out of the 11 regions of the country that had a tele-density lower than the national average [in July 2016], wireless subscriptions grew faster than the national average in only 3 regions viz., Madhya Pradesh, Haryana and Jammu & Kashmir. Is the mobile revolution adding to regions that it needs to?

Mobile Usage is now mostly data.

In the two years of 2016 and 2017, % of pre-paid users actually hasn’t changed much staying at around 95%. With more than 50% of India’s population below 25 years, I predict this number is probably going to stay here for a while.

We are talking more! Outgoing and incoming calls in these two years have gone up by 17% and 13% respectively. Do we have more things to share now all of a sudden or were we holding in things we wanted to share till call rates got lower?

SMS is dying and how! 30% drop in SMS sent per user in 2 years.

So are we spending more talking, WhatsApp-ing, Instagram-ing, Snapchat-ing? Apparently not. We are actually spending less. Like 33% lesser. Average-revenue-per-user [ARPU] per month has declined from INR 125 to INR 84. That is a huge drop!

Call rates have crashed [thanks Jio] that explains the increase in MoU. We now spend only INR 13 paise per minute of outgoing calls compared to INR 34 paise we used to spend only 2 years ago.

As SMS volumes started dropping, operators started bundling in free-SMS into all types of plans with the result that not only are SMS volumes dropping but also the cost of each SMS. From INR 15 paise to INR 12 paise. Yup, it’s almost the same cost to make a call as send an SMS. And we know when given the option to send a message or talk, we prefer…

But still, there are close to 18 billion SMS messages sent each month. That’s pretty huge, buuuuuut not big enough. We [I mean Indians] sent each other 20 billion WhatsApp messages in one day on New Year’s Eve! In one day.

And here’s the really interesting part.

While literally all components of the ARPU are crashing; from call rates to roaming charges to VAS revenue; there’s one part of the ARPU waterfall that’s actually inching up. Average-revenue-per-user-per-month from data usage.

We now spend [or more accurately operators make] INR 34 from each of us every month for the data we consume. This number was languishing around INR 28 for the longest time.

Data consumption via mobile is through the roof! From 134MB per subscriber per month in Jan 2016, the average mobile user today consumes 1610MB of data each month. That’s a 11X jump!

What the above point also means is data rates have crashed. By more than 90% from ~ INR 211/GB to INR 21/GB today. The ability of networks to scale up data users at almost zero incremental infrastructure cost is the secret to making this math work.

As services like AWS, Azure and others allow for scale deployment of apps and services and as operator networks get re-fitted to serve our data guzzling behaviour, the theory is that the system will reach a point where the cost, to the network, of adding a data user is close to zero. And the revenue from that user is INR 34 per month.

Now we also begin to mathematically understand the massive resistance operators put up to the Facebook Internet.org initiative. Data is the way out for operators to scale profits and Facebook was trying to make that free.

The big picture takeaway from all the usage changes impacting ARPU is that Data is eating into Voice while the contribution of everything else [viz., rentals, SMS revenue, VAS revenue, roaming, etc.] to ARPU has more or less remained the same.

So how can operators scale up profits?

So if data is the future for operators, how can they scale it up? 3 parts to the P&L statement: revenue/data user, cost of acquiring/retaining said data user, and cost of serving data. Can the revenue/data user go up? I predict it’s going to go down further.

Ok then how about lowering the cost of acquiring/retaining data users? Remember the Jio-Saavn deal that happened a couple of days ago? Or Airtel’s Amazon Prime Video offer for example. These are a couple of examples of operators focussed on creating content-led hooks to currently retain existing users.

Don’t be surprised if operators get into producing original content that can be accessed only from within their network soon.

And what about lowering the cost of serving the user. There’s a lot of work happening in this space especially in HSPA+ and LTE technology up-gradations and talks about re-farming 2G spectrum.

I also believe there’s probably a dynamic pricing playbook possible that maximizes revenue across the network with prices changing basis time/geography. Remember the “calls at night are free” offer we used to enjoy about a decade ago? Think of that but at a much larger scale.

In summary: Jio has/is re-defining what it means to be mobile operator. From a voice-focussed service to one that will very soon be comprised almost entirely of data. Sure we will continue to call each other as often as we do now [human contact is after-all a key component of our sociological grooming routine] but for an operator, if he/she hasn’t figured out how to make voice run on auto-pilot while focussing on building out the data/content/cloud layers, they will be disrupted soon enough, if not already.

fin.

Note: Most of the data in the above is from reports provided by TRAI. Have tapped into other secondary sources where needed. Ping me if you’d like to know which.